Can You Keep the Extra Insurance Money for Your Roof?

Introduction

When it comes to insurance claims for roof repairs or replacements, it’s common for homeowners to wonder if they can keep any extra money paid out by their insurance company. In some cases, insurance companies might pay more than the actual cost of the repair or replacement. This can leave homeowners with a surplus, raising questions about whether they can pocket the extra cash. In this article, we’ll explore the nuances of insurance claims for your roof and answer the question: “Can you keep the extra insurance money?”

Understanding Roof Insurance Claims

Roof insurance claims are filed when your roof has suffered damage from a covered peril, such as hail, wind, fire, or water damage. Insurance companies typically pay for the necessary repairs or replacement, minus your deductible. The process involves the following steps:

- Inspection: After you file a claim, your insurance company will send an adjuster to assess the damage. The adjuster’s report will determine the extent of the damage and the estimated cost of repairs.

- Estimate: The insurance adjuster will provide an estimate for the repair or replacement of your roof. This estimate is based on their assessment of the damage.

- Deductible: You are responsible for paying the deductible, which is the amount you agreed to when purchasing your insurance policy. This amount is typically subtracted from the insurance payout.

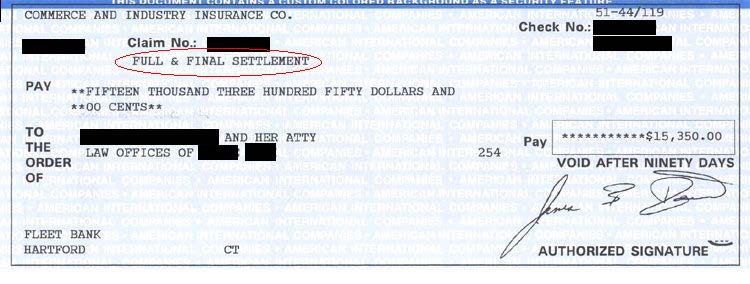

- Payment: Once the claim is approved, your insurance company will issue a check for the approved amount, minus the deductible, to cover the repair or replacement.

Excess Insurance Money

In some cases, the estimate provided by the insurance adjuster may be more than what it costs to repair or replace your roof. This can leave you with excess insurance money. While it may be tempting to keep this surplus, there are several important factors to consider:

- Policy Terms: First and foremost, it’s essential to review your insurance policy. Policies vary, and some may have specific clauses that dictate how excess insurance money should be handled. In some cases, you may be allowed to keep it, while in others, you may be required to return it to the insurance company.

- Ethical Considerations: Keeping excess insurance money when it’s not meant for you can raise ethical questions. Insurance policies are designed to cover the actual cost of repairs, not to provide a financial windfall.

- Future Claims: Keeping excess insurance money without following the terms of your policy can have consequences. If you have a future claim, your insurance company might not be as cooperative if they suspect you of misusing their funds.

- Local Laws and Regulations: Local laws and regulations can also come into play. Some states have specific rules regarding excess insurance money, so it’s important to understand the legal aspects in your area.

Options for Excess Insurance Money

If you find yourself with excess insurance money after a roof claim, you have several options:

- Contact Your Insurance Company: Start by discussing the situation with your insurance company. They can provide guidance on how to handle the surplus in accordance with your policy and local regulations.

- Use It for Repairs: One ethical option is to use the excess money for additional repairs or improvements to your property. This way, you’re ensuring that the funds are still benefiting your home.

- Return It: If your policy or local laws require it, you may need to return the excess insurance money to your insurance company.

Conclusion

The question of whether you can keep extra insurance money for your roof ultimately depends on your insurance policy, local laws, and ethical considerations. It’s crucial to review your policy, communicate with your insurance company, and ensure that you’re acting in compliance with both the terms of your policy and the law. While it might be tempting to keep any surplus funds, it’s essential to act responsibly and ethically when dealing with insurance claims to maintain a positive and cooperative relationship with your insurer.

If you find yourself in a situation where you need someone to help you with your insurance claims, contact T & J Xteriors in Helena and we can help explain the process a little more in detail.